By David J. Phillips

A retrospective analysis published by the BMJ supports previously published findings that diabetic patients taking drugs which target the incretin system to control their blood sugar are at greater risk for developing pancreatic problems, such as acute pancreatitis and pancreatic cancer. Could certain big pharma manufacturers be vulnerable to a price collapse, if European and U.S. regulators - who are now actively reviewing data on adverse events - move to restrict usage or outright remove these therapies from the market due to questionable safety?

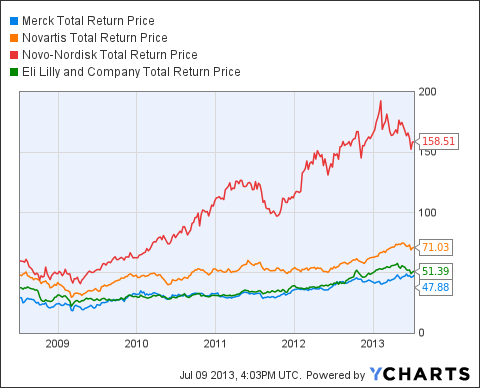

MRK Total Return Price data by YCharts

Incretin-based therapies, such as GLP-1 agonists and dipeptidylpeptidase-4 (DDP-4) inhibitors, mimic the glucose regulating role of intestinal hormones. As they carry a lower risk of hypoglycemia and have observed weight-loss properties, the two drug classes have readily been adopted by physicians for treating type-2 diabetes, with several drugs rapidly growing annual sales in the estimated $40 billion market for diabetes control medications.

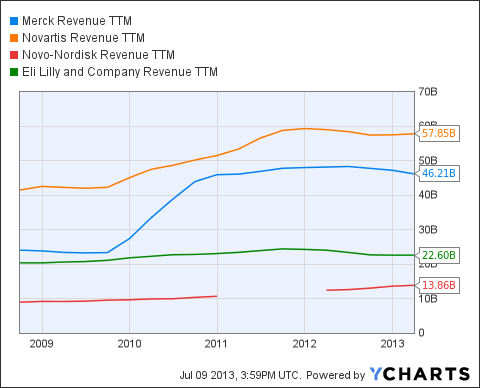

MRK Revenue TTM data by YCharts

As Merck ( MRK) looks to reset its revenue base due to patent losses, its DDP-4 inhibitor, Januvia (sitagliptin), remains critical to its financial health. In FY 2012, global sales of the combined diabetes franchise of Januvia/Janumet (which contains the popular type-2 diabetes drug metformin) grew 23% to $5.7 billion, primarily driven by growth in the United States and Japan. A global ban would wipe out more than 12% of the drug maker's annual sales

Though Novartis' ( NVS) DDP-V inhibitor Galvus delivered 34% growth in 2012, its $910 million in sales accounted for less than 2% of the $57 billion in annual drug sales. The Swiss-based company's growth engines are fueled by oncology and neuroscience drugs, such as Gleevec and Gilenya (multiple sclerosis).

The consumer advocacy group Public Citizen has petitioned the FDA to remove Novo Nordisk's ( NVO) Victoza (liraglutide). Albeit the Danish-based drug maker derives almost 10% of annual sales from this GLP-1 agonist, the current safety debate could actually benefit the company: Insulin products generated almost 60% of the $11.7 billion in drug revenue last year; and, with a global insulin market share of more than 47%, any move back to mainstream diabetic treatment would likely more than offset lost sales from Victoza.

In addition to lost sales, all drug makers of incretin mimetics, including the newer DPP-4 inhibitors - Tradjenta (linagliptin) from Eli Lilly ( LLY) and Nesina (alogliptin) from Takeda - will need to put aside reserves due to the possibility of multi-million dollar injury settlements (class action lawsuits are being filed).

David J. Phillips, a contributing editor at YCharts, is a former equity analyst. His journalism has appeared in Bloomberg BusinessWeek, Forbes, and Kiplinger's Personal Finance. From 2008 to 2011, David was a reporter for CBS News Interactive. He can be reached at editor@ycharts.com.

Published on : Wednesday, July 10, 2013

Category : Diabetes

Post URL : http://internal-med.blogspot.com/2013/07/merck-57-billion-diabetes-franchise-is.html

No comment to "Merck's $5.7 Billion Diabetes Franchise Is Vulnerable"

Post a Comment